- Phone :+917814622609

- Email :[email protected]

- Student Dashboard

CivlsTap Himachal, Himachal Pradesh Administrative Exam, Himachal Allied Services Exam, Himachal Naib Tehsildar Exam, Tehsil Welfare Officer, Cooperative Exam and other Himachal Pradesh Competitive Examinations.

General Studies Paper 2

Context:

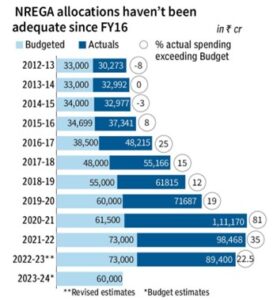

The Economic Survey 2022-23 showed that 6.49 crore households demanded work under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS). Of these, 6.48 crore households were offered employment by the government and 5.7 crore actually availed it. The Scheme was hailed for its role in mitigating the impact of the COVID-19 pandemic, when the number of workers had jumped post reverse migration from urban areas during the pandemic. In the Union Budget 2023-24, the Government has allocated INR 60,000 crore for the MGNREGS and has cut the funds by 33% compared to INR 89,000 crore in FY2022-23 (Revised Estimates). The step has been criticised as neglect of the poor sections and may lead to rural distress. However, the Ministry of Rural Development has sought to allay fears by clarifying that additional funds will be made available as and when the need arises.

Current status of MGNREGS:

- The Union Budget 2023-24 has allocated INR 60,000 crore for the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) scheme for FY2023-24. That is 18% lower than the INR 73,000 crore budget estimates for the current year (2022-23), and 33% lower than the INR 89,000 crore revised estimates (FY2022-23). The allocation in FY2023-24 is only 1.3% of the total expenditure compared to 2.1% last year.

- The average days of employment provided per household is at a 5-year low in this financial year. Till January 20, the average days of employment provided per household was only 42, while it ranged between 48 and 52 days in the preceding four years.

- According to Ministry Of Rural Development, the total active workers in 2022–23 are 15.12 crores. The number of households benefited were 5.78 crore in 2022-23.

Benefits of MGNREGS:

- Rural Development: The programme mandates that at least 60% of the works undertaken must be related to land and water conservation. The creation of these productive assets boost rural incomes as the majority of villages are agrarian. In some instances e.g., in Barmani village of Madhya Pradesh’s Sidhi district, creation of water conservation assets have increased availability of water. Some people who used to migrate earlier have now taken up farming.

- Tackling Water Stress: The water conservation structures built under MGNREGS have potentially conserved at least 28,741 million cubic metres of water in the past 15 years. The scheme has helped to mitigate the water stress to an extent.

- Curtailing Distress Migration: The scheme provides support in times of distress and individuals are not forced to migrate into cities. For instance, distress migration has stopped in Bandlapalli village in Andhra Pradesh’s Ananthapuramu district and the village is drought-proof today.

- Women Empowerment: Women workers account for more than 33% of the workers under MGNREGS. Money is transferred directly into the accounts of these women workers. This has supported women empowerment e.g., MGNREGS has led to the formation of the country’s largest group of trained women well-diggers in Pookkottukavu village of Kerala’s Palakkad district.

- Battling Uncertainties: There was a big jump in the number of workers from 2019-20 to 2020-21 (pandemic year). MGNREGS proved to be vital in providing relief to the migrants during the distress. It ensured income support to the vulnerable during the pandemic.

- Community Assets: The scheme has led to the creation of common community assets. These assets are built by communities on common lands thereby creating a sense of responsibility towards the structure which results in better care e.g., many Johads(percolation ponds) had remained abandoned for several years in many villages of Haryana. However, villagers revived them under the MGNREGS.

Challenges with the working of MGNREGS

- Gender Issues: Women and Men get equal remuneration under MGNREGS. However, various cases of discrimination against women have been reported wherein some regions, less job cards are issued to women or there are delays in the issue of cards.

- Regional Inequality: The success of MGNREGS depends on the performance of individual States. Although centrally funded, studies show uneven outcomes across different States. The performance of the MGNREGS, in terms of accountability, is much better in States like Andhra Pradesh and Tamil Nadu than in states like UP and Bihar.

- Insufficient Budget Allocation: MGNREGS’s success on the ground is dependent on proper and consistent funding flow to the states. Funds have dried up in States due to a lack of “mother sanctions” from the Union government, causing work to be difficult during peak season. Almost every year, more than 80% of funds are depleted in the first six months. As a result, the government’s claim of “record allocation” does not hold up in practise. It has actually decreased because pending liabilities from the previous year are included in the current budget. Furthermore, the allocated funds are insufficient to ensure proper implementation on the ground.

- Regular Delay in Payments: There is a regular delay in payments. Moreover, there is no provision of compensation in case of delayed payments despite the order of the Supreme Court. The delay is mainly due to failed payment transfer arising from inactive Aadhaar, and closed, blocked, or frozen bank account.

- Workers Penalised for Administrative Lapses: The Ministry withholds wage payments for workers of States that do not meet administrative requirements within the stipulated time period (for instance, submission of the previous financial year’s audited fund statements, utilisation certificates, bank reconciliation certificates etc). It is workers who end up being penalised for administrative lapses.

- Issues with Rural Banks: The rural banks are lack capacity in terms of staff and infrastructure and thus always remain hugely crowded. The workers normally have to visit the banks more than once to withdraw their wages. Due to great rush and poor infrastructure, the bank passbooks are not updated in many cases. Often, the workers do not get their wages during times of need due to the hassle and the cost involved in getting wages from the bank.

- Deletion of Job Cards: There are reports of genuine job cards are being randomly deleted as there is a huge administrative pressure to meet 100% Direct Benefit Transfer (DBT) implementation targets in MGNREGA. In states like Jharkhand, there are multiple examples where the districts had later requested to resume job cards after civil society interventions into the matter.

- Centralisation: A real-time MIS-based implementation and a centralised payment system has reduced the role of the representatives of the Panchayati Raj Institutions in implementation, monitoring and grievance redress of MGNREGA schemes. They have little or no power to resolve issues or make payments. The over-centralisation of the scheme has diminished the local accountabilities.

- Neglect of Local Priorities: MGNREGA could be a tool to establish decentralised governance. However, with the centralisation, the local issues are getting neglected. Linking MGNREGA to construction of Pradhan Mantri Awas Yojana(PMAY), individual household toilets, anganwadi centres and rural ‘haats’ have been destroying the spirit of the programme and gram sabhas and gram panchayats’ plans are being neglected.

- Online Attendance: The National Mobile Monitoring Software (NMMS) App allows for real-time attendance and geo-tagged photographs of workers at Mahatma Gandhi NREGA worksites. However, there are some concerns, such as poor internet connectivity, limited access to smartphones, and app glitches that have disrupted workers’ daily activities. Workers are being forced to purchase smartphones, which is causing them to leave their jobs. Many workers have expressed dissatisfaction with the process, and many are illiterate.

What steps can be taken to improve working of MGNREGS?

- The Parliamentary Standing Committee on Rural Development and Panchayati Raj has made several recommendations to improve the implementation of the Scheme.

- Increase in number of days of work: Under the scheme, State governments can ask for 50 days of work, in addition to the guaranteed 100 days, in case of exigencies arising from natural calamities. It recommended increasing the guaranteed days of work under the scheme from 100 days to 150 days.

- Revision of permissible works: The Committee observed that the ambit of permissible works under the scheme requires frequent revision. It recommended the Ministry of Rural Development to consult stakeholders and include area-specific works under MGNREGA as per local needs. These may include, construction of bunds to stop land erosion during floods, and boundary works for agricultural fields to protect them from grazing animals.

- Uniform Wage Rate: Wage rates notified under MGNREGA range from INR 193 to INR 318 in different States/UTs. The Committee noted that this fluctuation in wage rates across States/UTs is not justified. It recommended devising a mechanism for a unified wage rate across the country.

- Increase in wages commensurate with inflation: The Committee noted that beneficiaries of MGNREGA generally belong to poor and marginalised sections of society. It observed that the nominal wages under MGNREGA discourage beneficiaries and propel them to either seek more remunerative work or migrate to urban areas. The Committee noted that indexing MGNREGA wages to Consumer Price Index (CPI)-Rural as opposed to CPI-Agricultural Labour, (as recommended by Dr. Nagesh Singh Committee), has not been implemented. The Standing Committee recommended the Ministry to review its position and increase the wages.

- Delay in Compensation: In case of delay in payment of wages under MGNREGA, beneficiaries are entitled to compensation at the rate of 0.05% of unpaid wages per day for the duration of delay. The Committee noted that payment of delay compensation is not adhered to in most places in the country. The Ministry must ensure strict compliance in payment of compensation.

- Social Audits: Under MGNREGA, the Gram Sabha must conduct regular social audits of all projects taken up within the Gram Panchayat. The Committee observed that implementation of this provision is poor. The Gram Panchayats must not go unaudited during the financial year. Also, Social audit reports are not publicly available. These reports must be placed in the public domain promptly after the audit exercise is over.

- Appointment of Ombudsperson: Under the Act, there should be an ombudsperson for each district who will receive grievances, conduct enquiries, and pass awards. Out of 715 possible appointments, so far only 263 ombudsmen have been appointed which shows poor coordination between the Union and State nodal agencies. Punitive measures can be imposed or funds can be stopped for States for failing to appoint ombudsmen. The Committee recommended the Department of Rural Development to bring on board all State governments to comply with appointment of ombudsmen.

General Studies Paper 2

Context:

- Recently, the Prime Minister of India recognized the valued utilization of India-UAE CEPA by Indian Exporters.

Comprehensive Economic Cooperation Agreement (CEPA)

- CEPA is a comprehensive agreement between India and the United Arab Emirates that seeks to enhance the economic and commercial ties between the two countries.

- The agreement aims to increase trade and investment,improve market access, and promote economic growth between India and the UAE.

- CEPA was signed in 2020and is seen as a significant milestone in the economic relationship between India and the UAE.

- Under CEPA, the two countries have committed to reducing barriers to trade and investment, which will make it easier for businesses from both countries to engage in trade and investment activities.

- The agreement includes provisions for reducing tariffs on goods, services, and investment, as well as for promoting the movement of people, goods, and services between India and the UAE.

- CEPA is expected to provide a major boost to the economic relationship between India and the UAE, as it will increase trade and investment, improve market access, and provide a more favorable environment for businesses to operate in.

- The agreement is expected to benefit a range of sectors, including but not limited to information technology, engineering, pharmaceuticals, and services sectors.

- CEPA is expected to promote the development of economic and commercial ties between India and the UAE, and to provide a foundation for further cooperation between the two countries in the future.

- It is projected to reach US$100 billion in goods trade and over US$1.5 billion in trade in services in the next five years. Built on three pillars of trust, transparency, and talent.

Benefits

- For India:

- Preferential market access provided by the UAE on more than 97 percent of its tariff lines, accounting for 99 percent of Indian exports to the UAE in value terms

- Preferential market access for labour-intensive goods such as textiles, leather, footwear, sports goods, plastics, furniture, agricultural and wood products, engineering goods, pharmaceuticals, and automobiles

- Preferential market access for services sector including computer-related services, health, tourism, travel, engineering, and accountancy

- Creation of more than one million jobs for the Indian workforce through enhanced trade liberalisation and market access

- UAE committed to issuing 140,000 employment visas to skilled Indian professionals by 2030

- Three-year visa for intra-corporate transferes and a 90-day visa for business visitors and contractual suppliers from India

- Benefits for the UAE:

- Boost to the UAE’s GDP (US$9 billion) by 1.7 percent by 2030

- Zero-duty market access for 90 percent of exports from the UAE into India, benefiting commodity exporters of petrochemicals, aluminum, and copper.

Importance of UAE

- Trade and Investment: UAE is one of India’s largest trading partners, with bilateral trade reaching nearly $60 billion in 2019-20. UAE is also a significant source of foreign investment for India.

- Energy Security: UAE is a major supplier of oil to India, making it an important partner in India’s energy security.

- Strategic Location: UAE’s location makes it a gateway for India to access the wider Gulf region and Africa.

- People-to-People Ties: There is a large Indian diaspora in the UAE, estimated to be around 3 million people, making it a significant cultural and economic bridge between the two countries.

- Political and Defence Cooperation: India and UAE have a strong political and defence relationship, with regular high-level exchanges and cooperation on regional and global issues.

Challenges

- Balancing Relations with Iran: India has traditionally maintained close ties with Iran, but the UAE has been critical of Iran’s regional behaviour and has sought to counter its influence. India has had to balance its relationships with both countries, which has at times led to tensions.

- Competition for Influence in the Gulf: Both India and the UAE are seeking to increase their influence in the Gulf region, and this competition has sometimes led to friction in their relationship.

- Differences on Regional Issues: India and the UAE have different perspectives on some regional issues, such as the conflict in Syria, which has at times created tension in their relationship.

- Labor Issues: There have been concerns raised about the treatment of Indian workers in the UAE, which have sometimes strained relations between the two countries.

Way Ahead

- Despite these challenges, India and the UAE continue to work towards strengthening their relationship and overcoming these obstacles. Both countries recognize the importance of their relationship and have taken steps to deepen cooperation in various areas, including trade, investment, energy security, and people-to-people ties.

- Overall, the UAE is an important partner for India in several areas, and the two countries continue to work towards strengthening their relationship.

General Studies Paper 3

Context:

- Recently, the Union Finance Minister presented the Budget in Parliament.

Budget highlights

- Agriculture:

- Atmanirbhar Clean Plant Program

- The program to be launched to boost availability of disease-free, quality planting material for high value horticultural crops.

- GOBARdhan:

- 500 new ‘waste to wealth’ plants under GOBARdhan (Galvanizing Organic Bio-Agro Resources Dhan) schemeto be established for promoting circular economy.

- Bio-Input Resource Centres:

- Centre to facilitate one crore farmers to adopt natural farming over the next three years.

- For this, 10,000 Bio-Input Resource Centres to be set-up, creating a national-level distributed micro-fertilizer and pesticide manufacturing network.

- Agriculture Accelerator Fund:

- Agriculture Accelerator Fund to be set-up to encourage agri-startups by young entrepreneurs in rural areas.

- Environment:

- PM-PRANAM:

- “PM Programme for Restoration, Awareness, Nourishment and Amelioration of Mother Earth” (PM-PRANAM)to be launched to incentivize States and Union Territories to promote alternative fertilizers and balanced use of chemical fertilizers.

- MISHTI:

- ‘Mangrove Initiative for Shoreline Habitats & Tangible Incomes’, MISHTI, to be taken up for mangrove plantation along the coastline and on salt pan lands, through convergence between MGNREGS, CAMPA Fund and other sources.

- Green Credit Programme:

- Green Credit Programme to be notified under the Environment (Protection) Act to incentivize and mobilize additional resources for environmentally sustainable and responsive actions.

- Amrit Dharohar scheme:

- Amrit Dharohar scheme to be implemented over the next three years to encourage optimal use of wetlands, enhance bio-diversity, carbon stock, eco-tourism opportunities and income generation for local communities.

- Skill Development:

- PM-PRANAM:

- Atmanirbhar Clean Plant Program

- Pradhan Mantri Kaushal Vikas Yojana 4.0

- It is to be launched to skill lakhs of youth within the next three years covering new age courses for Industry 4.0 like coding, AI, robotics, mechatronics, IOT, 3D printing, drones, and soft skills.

- Skill India International Centres:

- 30 Skill India International Centres to be set up across different States to skill youth for international opportunities.

- Businesses & Start Ups:

- National Data Governance Policy:

- National Data Governance Policy to be brought out to unleash innovation and research by start-ups and academia.

- ODOPs (One District, One Product):

- States to be encouraged to set up a Unity Mallfor promotion and sale of their own and also all others states’ ODOPs (One District, One Product), GI products and handicrafts.

- MSME:

- National Data Governance Policy:

PM Vishwakarma Kaushal Samman (PM VIKAS):

- The first-of-its-kind package assistance endeavours to improve the quality of, scale and reach of the products made by traditional artisans and craftspeople.

- Components of the scheme would not provide for financial support but also access to advanced skill training, knowledge of modern digital techniques and efficient green technologies, digital payments and social security.

Vivad se Vishwas I:

- If MSMEs failed to execute contracts during the pandemic period, 95% of the forfeited amount relating to bid or performance security would be returned to them by the government or its undertakings.

Education:

- Eklavya Model Residential Schools:

- Centre to recruit 38,800 teachers and support staff for the 740 Eklavya Model Residential Schools, serving 3.5 lakh tribal students over the next three years.

- District Institutes of Education and Training:

- District Institutes of Education and Training to be developed as vibrant institutes of excellence for Teachers’ Training.

- National Digital Library:

- A National Digital Library for Children and Adolescents to be set-up for facilitating availability of quality books across geographies, languages, genres and levels, and device agnostic accessibility.

- Savings scheme for women – Mahila Samman Saving Certificate:

- One-time new saving scheme Mahila Samman Saving Certificate for women to be made available for 2 years up to March 2025.

- It will offer deposit facility of up to Rs 2 lakh in the name of women or girls for tenure of 2 years at fixed interest rate of 7.5 percent with partial withdrawal option.

- Governance:

- Entity DigiLocker:

- Entity DigiLocker to be setup for use by MSMEs, large business and charitable trusts to store and share documents online securely.

- Jan Vishwas Bill:

- Jan Vishwas Bill to amend 42 Central Acts have been introduced to further trust-based governance.

- Entity DigiLocker:

- Eklavya Model Residential Schools:

The Urban Infrastructure Development Fund:

- Urban Infrastructure Development Fund (UIDF) will be established through use of priority Sector Lending shortfall, which will be managed by the national Housing Bank, and will be used by public agencies to create urban infrastructure in Tier 2 and Tier 3 cities.

- It would provide the impetus needed for the growth of infrastructure in cities.

Technology:

- Make AI in India and Make AI work for India:

- Three centres of excellence for Artificial Intelligence to be set-up in top educational institutions to realise the vision of “Make AI in India and Make AI work for India”.

- Tourism:

- ‘Dekho Apna Desh’ initiative:

- Sector specific skilling and entrepreneurship development to be dovetailed to achieve the objectives of the ‘Dekho Apna Desh’ initiative.

- Vibrant Villages Programme:

- Tourism infrastructure and amenities to be facilitated in border villages through the Vibrant Villages Programme.

- Finance:

- National Financial Information Registry:

- National Financial Information Registry to be set up to serve as the central repository of financial and ancillary information for facilitating efficient flow of credit, promoting financial inclusion, and fostering financial stability.

- A new legislative framework to be designed in consultation with RBI to govern this credit public infrastructure.

- Comprehensive review:

- Financial sector regulators to carry out a comprehensive review of existing regulations in consultation with public and regulated entities. Time limits to decide the applications under various regulations would also be laid down.

- National Financial Information Registry:

- ‘Dekho Apna Desh’ initiative:

- Make AI in India and Make AI work for India:

Direct Taxes

- Income Tax:

- Budget 2023 focused on raising capital expenditureby the government, fiscal consolidation, and attractive incentives and rebates in the new income tax regime.

- Income Tax payers:

- No changes in the old tax regime

- New tax regime to become the default tax regime. However, citizens can opt for the old tax regime.

- No tax on income up to Rs 7.5 lakh a year in new tax regime (with inclusion of standard deduction)

- Govt proposes to reduce highest surcharge rate from 37% to 25% in new tax regime

- New Income Tax Slabs Under New Tax Regimes:

- Rs 0-3 lakh: Nil

- Rs 3-6 lakhs: 5%

- Rs 6-9 lakhs: 10%

- Rs 9-12 lakhs: 15%

- Rs 12-15 lakhs: 20%

- Rs Over 15 lakhs: 30%

Indirect Taxes

- Through increased Indirect Taxes, following products will get Cheaper:

- Mobile phones

- TV

- Lab-grown diamonds

- Shrimp feed

- Machinery for lithium ion batteries

- Raw materials for EV industry

- Through reduction of Indirect Taxes, following products will get Costlier:

- Cigarettes

- Silver

- Compounded rubber

- Imitation Jewellery

- Articles made from gold bars

- Imported bicycles and toys

- Imported kitchen electric chimney

- Imported luxury cars and EVs

General Studies Paper 3

Context:

- The budget for 2023-24 is an innovative amalgamation. It comes when there are impending state elections and the general election in 2024.

Budget:

- The government’s blueprint on:

- expenditure

- taxes it plans to levy

- other transactions which affect the economy and lives of citizens.

- Article 112 of the Indian Constitution: Union Budget of a year is referred to as the Annual Financial Statement (AFS).

- The Budget Division of the Department of Economic Affairs in the Finance Ministry is the nodal body responsible for preparing the Budget.

- Components of the Budget:

- expenditure

- receipts

- deficit indicators.

- Depending on the manner in which they are defined, there can be many classifications and indicators of expenditure, receipts and deficits.

Why is the budget 2023-24 responsive?

- The priorities articulated in the vision for Amrit Kaal:

- opportunities for citizens with a focus on the youth

- growth and job creation

- strong and stable macroeconomic environment

- Saptarishi(seven priorities)

- infrastructure and development

- green growth

- financial sector

- inclusive development

- reaching the last mile, to mention a few.

Why is the budget 2023-24 responsible?

- It achieves the stipulated fiscal deficit of 6.4(six point four)percent of GDP

- It seeks a half percentage point correction — primarily from an unwinding of subsidies (food and fertilizer of 6(zero point six)pp of GDP;likely reflecting both withdrawal of Covid-related relief and global commodity tailwinds)

- Continued decline in the ratio of revenue to capital spending.

- A modest nominal GDP and tax buoyancy

Aims in budget:

- The budget aims for restraint on borrowings of CPSEs (2(one point two)percent of GDP).

- Excluding state PSEs for which we do not have reliable estimates

- Allowing for some buffer in states’ estimates

Positives from fiscal and debt consolidation for the sovereign:

- It enhances resources available for countercyclical fiscal policies in the event of negative shocks such as Covid

- It envisages social spending in critical areas such as health and education where India’s public spending remains markedly low.

Does the budget address issues in the health and education sectors?

- With a hike of 2.7(two point seven) percent relative to what was originally budgeted in FY23.

- Health expenditure is now assumed at Rs 88,956 crore.

- The 157 new nursing colleges will improve human resource capability and primary health centers.

- Education: The enhanced allocation in school and higher education of Rs 68,804 and Rs 44,094 crore respectively, represents an increase of 8 percent in both.

- Improved outcomes through the National Digital Library,and revamp of teacher training, in line with the overall vision for a digital economy.

What does the budget do for India’s commitment for an orderly transition to a Green Economy?

The announcements included:

- Rs 35,000 crore allocation for energy transition and net-zero carbon emission targets

- An annual production target of 5 MMT by 2030for Green Hydrogen Mission

- Green Credit Programme under the Environment (Protection) Act to incentivise sustainable actions.

Agriculture and railways:

- Both sectors crucial for employment and for the low- and middle-income population

- A massive increase in targeted credit for high-growth, high-value agriculture

- Increase in the capital outlay for railways, highest in a decade.

What steps need to be taken?

- Continued reforms on tax policies and administration would be needed to close the potential revenue gap.

- Unfinished agenda of GST reforms by way of slab rationalization and moving towards a revenue neutral rate needs upward recalibration of 3 to 4 percentage points.

- Preference should be to revisit allocations in the areas of health, education, and green economy.

Way Forward

- The rationalization of direct taxes in reducing one slab is an effort in the right direction.

- Over a period, the slabs need further rationalization as also the elimination of wide-ranging exemptions.

- The encouragement to states through:

- Rs 3(one point three)lakh crore for capex as a 50-year loan

- tantamount to a grant

- Extra headroom for borrowing

- It should enable state governments to utilize these resources to improve growth and development outcomes, including in critical areas like health and education.

- Issues of innovative financing, risk mitigation for crowding in private investments and securing participation of multilateral institutions would need continuing engagement.

- This budget has the stamp of this wisdom: It has been said, “We must not promise what we ought not, lest we be called on to perform what we cannot.”

General Studies Paper 2

Context:

- A warning by the International Monetary Fund (IMF)that global trade would slow down from 4(five point four)% in 2022 to 2.4(two point four)% in 2023.

What is an FTA?

- FTA is a pact between two or more nations to reduce barriers to imports and exports among them.

- Under a free trade policy: Goods and services can be bought and sold across international borders with little or no government tariffs, quotas, subsidies, or prohibitions to inhibit their exchange.

- Protectionism: The concept of free trade is the opposite of trade protectionism or economic isolationism.

- FTAs can be categorized as:

- Preferential Trade Agreement (PTA)

- Comprehensive Economic Cooperation Agreement (CECA)

- Comprehensive Economic Partnership Agreement (CEPA)

What does FTA cover?

- Tariff reduction impacting the entire manufacturing and the agricultural sector

- Rules on services trade

- Digital issues such as data localisation

- Intellectual property rights that may have an impact on the accessibility of drugs

- Investment promotion, facilitation, and protection.

IMF book, “South Asia’s Path to Resilient Growth”:

- It argues that a strong base exists for South Asia trading more with dynamic East Asia

- The total merchandise trade between South Asia and East Asia (in dollar terms) grew at about 10% annually between 1990 and 2018 to $332 billion in 2018

- It could reach about $500 billion looking ahead.

- The handful of free trade agreements (FTAs) linking economies in South Asia with East Asia may rise to 30 by 2030.

Background:

- Since the 1990s,South Asia-East Asia trade has gathered pace

- Trade is linked to

- India’s trade re-aligning towards East Asia through its ‘Look East’ and ‘Act East’ policies

- South Asia adopting reforms

- China offshoring global supply chains to Asia.

What needs to be done?

- Regional trade integration across Asia can be encouraged by gradually reducing barriers to goods and services trade.

- South Asia’s trade opening should be calibrated with tax reforms as trade taxes account for much of government revenue in some economies.

- Adjusting financing to losing sectors to reallocate factors of production and re-training of workers to promote gains from trade and mitigate income inequality.

- Improve the performance of special economic zones (SEZs) and invest in services SEZs to facilitate industrial clustering and exports.

- Pursue comprehensive FTAs that eventually lead to the Regional Comprehensive Economic Partnership (RCEP) to provide for a regional rules-based trade to insure against rising protectionism.

- South Asian economies need to improve tariff preference use by better preparing business in navigating the complex rules of origin in FTAs

- Including issues relevant to global supply chains in future FTAs.

- Reinvented trade-focused Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) can facilitate stronger trade ties and support the interests of smaller members.

Some FTA’s in South Asia:

- Japan-India FTA

- Sri Lanka-Singapore FTA

- Pakistan-Indonesia FTA.

South Asia has over 600 SEZs in operation:

- Kochi (India)

- Gwadar (Pakistan)

- Mirsarai (Bangladesh)

- Hambantota (Sri Lanka).

Way Forward

- Regional trade in Asia is recovering after the COVID-19 pandemic and has opened opportunities for South Asia to participate in global value chains and services trade.

- Improving SEZ processes and outcomes in South Asia requires:

- ensuring macroeconomic and political stability

- adopting good practice regulatory policies towards investors

- providing reliable electricity

- 5G broadband cellular technology

- upgrading worker skills.

- India has also concluded FTAs with the United Arab Emirates and Australia in 2022: The confidence gained from these can help prepare for future RCEP membership by undertaking structural reforms.

- It will boost business competitiveness in supply chains and foster greater regulatory coherence with East Asia.

- If India joins RCEP, the rest of South Asia may be incentivised to join out of a fear of being left out and suffering from trade diversion effects.

- Reinventing BIMSTEC requires better resourcing its Secretariat, concluding the long-running BIMSTEC FTA, building trade capacity in smaller economies, and introducing dialogue partner status to encourage open regionalism in Asia.

- A narrower geographical coverage between South Asia and Southeast Asia may be a building block for eventual trade integration across Asia.

- To mitigate a backlash against regionalisation, the larger economies should facilitate gains from trade to the smaller economies.

- Having the political will to implement pro-trade policies can improve the lives of Asians.

- India is South Asia’s largest economy and its G-20 presidency can be a good platform to initiate these changes.

General Studies Paper 2

Context:

India and the United States elevated their strategic partnership with the launch of an initiative on Critical and Emerging Technology or iCET.

Initiative on Critical and Emerging Technologies (iCET)

- About:

- The iCET involves collaboration in a range of areas including

- Quantum computing,

- Semiconductors,

- 5G and 6G wireless infrastructure, and

- Civilian space projects such as lunar exploration.

- Aim:

- iCET aims to position the two countries as trusted technology partners by building technology value chains and supporting the co-development and co-production of items.

- It also aims to address regulatory restrictions, export controls and mobility barriers through a standing mechanism

- Defecnce:

- On the defence front, iCET aims to expand India-US cooperation in fields like artificial intelligence and military equipment.

- Industrial cooperation:

- The iCET announced a new bilateral defence industrial cooperation roadmap that will be intended to accelerate defence technology cooperation.

- Fighter jet engine production in India:

- The USA under this has also agreed to produce a fighter jet engine in India for the indigenously manufactured Light Combat Aircraft.

- GE Aerospace has applied for an export licence for jet engine production and phased transfer of technology to Indian entities.

- The USA under this has also agreed to produce a fighter jet engine in India for the indigenously manufactured Light Combat Aircraft.

- The iCET involves collaboration in a range of areas including

Significance

- Depth to the relationship:

- If implemented with speed and purpose, the bilateral Initiative on Critical and Emerging Technologies (iCET) could lend a new strategic depth and breadth to the expanding engagement between India and the United States.

- Against the rising and assertive China:

- Lending urgency to the iCET is the growing convergence of Indian and US interests in managing the security, economic, and technological challenges presented by a rising and assertive China.

- Reducing dependence on Russia:

- India is also looking to reduce its over-dependence on Russian weapons and military technology and to produce more weapons at home in partnership with western countries.

Challenges

- Hurdles on Indian side:

- The US has flagged the need for regulatory and policy consistency and overcoming tax and custom hurdles on the Indian side.

- China factor:

- The new initiative has also been criticized by China.

- China believes India is willing to ramp up its ties with the US to advance technology and attract more funding to replace its position in the global industrial and supply chains.

- Though, iCET has no explicit reference to China.

India-USA Relations

- About:

- India and US share values of democracy, rule of law, human rights, and religious freedom that bind the countries together.

- Bilateral engagement:

- India and the United States enjoy a comprehensive global strategic partnership covering almost all areas of human endeavour, driven by shared democratic values, convergence of interests on a range of issues, and vibrant people-to-people contacts.

- Regular exchanges at the leadership level have been an integral element of the expanding bilateral engagement.

- Despite the COVID-19 pandemic, India-U.S. cooperation witnessed intense engagement under various bilateral dialogue mechanisms in a wide range of areas including defence, security, health, trade, economic, science & technology, energy and people-to-people ties.

- Defence and Security:

- India-US defence cooperation is based on the “New Framework for India-US Defence Cooperation”, which was renewed for a period of ten years in 2015.

- In 2016, the defence relationship was designated as a Major Defence Partnership (MDP).

- The MDP recognizes a shared desire to build a comprehensive, enduring and mutually beneficial defence partnership.

- Several defence agreements have been signed in recent years. These includes:

- Logistics Exchange Memorandum of Association (August 2016)

- Memorandum of Intent between the U.S. Defence Innovation Unit (DIU)

- the Indian Defence Innovation Organisation – Innovation for Defence Excellence (2018)

- Communications Compatibility and Security Agreement (September 2018)

- Industrial Security Agreement (December 2019);

- Basic Exchange and Cooperation Agreement (October 2020).

- Bilateral military exercises and defence exchanges are important aspects of deepening military-to-military cooperation.

- In addition to a number of service-to-service exercises, 2019 a tri-services exercise– Tiger Triumph– was conducted in November 2019.

- Bilateral and regional exercises include Yudh Abhyas (Army); Vajra Prahar (Special Forces); RIMPAC; Red Flag.

- In November 2020, the Royal Australian Navy joined the U.S.-India-Japan MALABAR Naval Exerciseheld in the Bay of Bengal and the Arabian Sea.

- Both sides have conducted a number of PASSEX with the US carrier groups in the Indian Ocean Region.

- Quad:

- The four Quad partners (India, Japan, United States & Australia) first formed a “Core Group” in 2004, to swiftly mobilise aid during the joint response to the 2004 Tsunami. Since 2017, Quad engagements have increased and intensified.

- In 2019, the first Quad Foreign Ministerial Meeting was held in New York (December 2019).

- Counter-Terrorism Cooperation:

- Cooperation in counter-terrorism has seen considerable progress with information exchange, operational cooperation and sharing of counterterrorism technology and equipment. India-U.S. Joint Working Group on Counter-Terrorism oversees the expanding CT cooperation.

- Cyber Security Cooperation:

- The India-US Cyber Framework signed in September 2016, provides for expanding cooperation in the cyber domain.

- Trade & Economic Relations:

- The rapidly expanding trade and commercial linkages form an important component of the multi-faceted partnership between India and the United States.

- The U.S. is India’s second-largest trading partner and a major destination for our exports of goods and services.

- Bilateral trade in goods and services stood at US$ 146 billion in 2019.

- During the financial year 2020-21, India received the highest ever foreign direct investment amounting to USD 81.72 billion, as per data published by the Ministry of Commerce and Industry, Government of India.

- The US replaced Mauritius as the second largest source of foreign direct investment into India during 2020-21 with inflows of USD 13.82 billion.

- The US is one of the top 5 investment destinations for Indian FDI.

- Energy sector:

- India and the US have a strong bilateral partnership in the energy sector.

- In 2010, a bilateral Energy Dialogue was launched.

- Science and Technology:

- India-US cooperation in Science and Technology is multi-faceted and has been growing steadily under the framework of the India-US Science and Technology Cooperation Agreement signed in October 2005, which was renewed for a period of ten years in September 2019.

- ISRO and NASA are working together to realise a joint microwave remote sensing satellite for Earth observation, named NASA ISRO Synthetic Aperture Radar (NISAR).

- Education partnership:

- It is an important pillar of India-US ties and both countries share strong linkages and a history of higher education collaborations.

- The United States Educational Foundation in India (USEFI) was set up after a bilateral agreement on education exchange was signed between India and the US on February 2, 1950.

- Indian Diaspora:

- About 4.2 million Indian American/Indian origin people reside in the US. The Indian Americans [3.18 million] constitute the third largest Asian ethnic group in the US

General Studies Paper 2

Context:

- China and Russia unveiled a partnership “without limits” and with no “forbidden areas” in Feb 2022. Russia and China had a strategic partnership for a long time. The Beijing declaration did lay out a solid basis for jointly confronting the West.

What were the Russian calculations for invading Ukraine?

- Putin had hoped that his military offensive would lead to quick collapse of the regime in Ukraine and occupation of Ukraine. This will impact the European security order.

- It will deeply divide Europe and fracture the US-led trans-Atlantic security system. After the US withdrawal from Afghanistan, occupation of Ukraine will further undermine the credibility of the US as a global power.

- Putin’s victory in Europe would have had a dramatic impact on Asia. It would have weakened US alliances in Asia and boosted China’s ambition to radically reshape its periphery. China would have used force for unification with Taiwan.

How has the Ukraine war played out?

- Ukraine’s determination has prevented the quick collapse of the regime in Kyiv. It has helped to mobilise massive military assistance from the Western world.

- Putin is locked in a stalemate. He has lost nearly 50% of the territory Russia gained in eastern Ukraine during the early phase of the invasion.

- Russia’s military material and manpower losses have been immense. Moscow faces a harsh regime of Western economic sanctions.

What are the geostrategic implications of the Sino-Russia alliance and Ukraine war?

- Putin and Xi have facilitated the Western unity under American leadership. The Ukraine invasion has also allowed the US to put simultaneous pressure on both China and Russia.

- In Europe, the Ukraine war has helped the US to galvanize and expand NATO.

- The Russian invasion has also triggered the fear of Chinese territorial expansionism in Asia. This has led to the strengthening of US bilateral alliances with Australia and Japan. The US has significantly raised its military and political support for Taiwan.

- The Sino-Russian alliance and the Ukraine war have seen Germany and Japan joining the battle against Moscow and Beijing.

- Japan and Germany happen to be the world’s third and fourth largest economies. Their mobilisation significantly alters the so-called “balance of powers”between the West and the Moscow-Beijing axis.

- Both Berlin and Tokyo are now committed to raising their defence spending to deal with the security challenges from Moscow and Beijing.

- Washington is limiting the influence of Russia and China in Eurasia by bringing its alliances and partnerships in Europe and Asia closer.

- Leaders of America’s Asian allies joined for the first time a NATO summit last June in Madrid. NATO has promised to take a greater interest in shaping the Indo-Pacific balance of power.

- There is a growing prospect that Moscow will become more beholden to Beijing after Putin’s military misadventure in Ukraine. Beijing is unlikely to abandon Moscow. A weakened Putin will remain a valuable asset for Xi even as Beijing seeks to limit some of the new Western hostility to China.

How is it impacting India?

- China can increase the military pressure on the disputed border with India.

- Delhi depends on Russian military supplies to cope with the PLA challenge and Moscow is now a junior partner to Beijing. This is certainly not a good situation for India.

- Dependence on Russian arms has severely constrained India’s position on Ukraine. It has cast a shadow over Delhi’s engagement with Europe and the US. It is now the biggest constraint on India’s freedom of action.

- India is facing the prospect of a unipolar Asia dominated by a rising and assertive China. So. it has turned to the US and its allies to restore the regional balance of power.

- The transition has become more urgent and complicated by the new Sino-Russian alliance Ukraine war.

General Studies Paper 3

Context:

- Recently, the Union Minister for Finance tabled the Economic Survey 2022-23 highlighting the outlook for India’s growth, inflation and unemployment in the coming years.

About

- The Economic Survey of India suggests that the economy has recovered from the Covid disruption and is poised for sustained robust growth in the rest of the decade.

- The Survey attributes the recovery to wide-ranging structural and governance reforms that have strengthened the economy’s fundamentals and increased its efficiency.

- The Indian economy is expected to grow at its potential similar to the growth experience after 2003, but the growth outlook is unlikely to be much above 6%.

- The growth rate in India has become increasingly capital-intensive, leading to a lower labor force participation rate and widespread joblessness, which acts as a drag on economic growth.

- India’s population is growing with a large youth bulge, high levels of poverty, and malnourished children, which requires faster growth to satisfy the growing population

- The survey cautions that a growth rate of 6% may not create enough jobs to meet the demand from the growing population.

What is the Economic Survey?

- The Economic Survey has its roots in the British colonial era, with the first survey being presented in 1950-51.

- The Economic Survey of India is an annual document presented to the Parliament by the Ministry of Finance.

- It reviews the performance of the Indian economy in the previous financial year and presents the outlook for the next year.

- It is prepared by the Economic Division of the Department of Economic Affairs(DEA) of the Ministry of Finance and is not governed by any specific act or legislation.

- The comments or policy solutions contained in the Survey are not binding on the government.

Major Findings of the Survey

- State of the Economy 2022-23:

- The Indian economy is staging a broad-based recovery across sectors after recovering from pandemic-induced contraction, Russian-Ukraine conflict and inflation.

- India’s GDP growth is expected to remain robust and in the range of 6-6.8 % in Financial Year 2023-24, but detailed some downside risks, such as low demand for exports, sustained monetary tightening, etc.

- Inflation:

- The RBI projects headline inflation at 6.8% in FY23, outside its comfort zone of 2% to 6%, but the Survey is optimistic about the inflation levels and trajectory.

- Steps taken by government to control inflation included:

- Phase wise reduction in export duty of petrol and diesel

- Import duty on major inputs were brought to zero

- Prohibition on the export of wheat products under HS Code 1101 and

- Imposition of export duty on rice.

- External Sector:

- Merchandise exports were US$ 332.8 billion for April-December 2022.

- India diversified its markets and increased its exports to Brazil, South Africa and Saudi Arabia.

- To increase its market size and ensure better penetration, in 2022, Comprehensive Economic Partnership Agreement (CEPA)with UAE.

- The Economic Cooperation and Trade Agreement (ECTA)with Australia came into force.

- India is the largest recipient of remittances in the world receiving US$ 100 bn in 2022.

- Remittances are the second largest major source of external financing after service export.

- Agriculture & Food Management:

- Private investment in agriculture has increased to 9.3% in 2020-21.

- Free foodgrains to about 81.4 crore beneficiaries is being provided under the National Food Security Act for one year from January 1, 2023.

- Services:

- The services sector is expected to grow at 9.1% in FY23, as against 8.4% (YoY) in FY22.

- India was among the top ten services exporting countries in 2021, with its share in world commercial services exports increasing from 3 per cent in 2015 to 4 per cent in 2021.

- Digital Infrastructure:

- Unified Payment Interface (UPI)-based transactions grew in value (121 per cent) and volume (115 per cent) terms, between 2019-22, paving the way for its international adoption.

- More than 98 per cent of the total telephone subscribers are connected wirelessly.

- The overall tele-density in India stood at 84.8 per cent in March 2022.

- Physical Infrastructure:

- National Logistics Policy envisions developing an integrated, cost-efficient, resilient logistics ecosystem in the country for accelerated and inclusive growth.

- Inland Vessels Act 2021replaced the 100-year-old Act to ensure hassle free movement of Vessels promoting Inland Water Transport.

- Climate Change and Environment:

- India declared the Net Zero Pledge to achieve net zero emissions goal by 2070.

- India achieved its target of 40 per cent installed electric capacity from non-fossil fuels ahead of 2030.

- A mass movement LIFE (Lifestyle for Environment) was launched.

- Sovereign Green Bond Framework (SGrBs) was issued in November 2022.

- National Green Hydrogen Mission launched to enable India to be energy independent by 2047.

- Unemployment:

- Employment levels have risen in the current financial year, with job creation appearing to move into a higher orbit. The urban unemployment rate for people aged 15 years and above declined from 9.8% to 7.2%.

- Implications for India’s economy:

- The Survey suggests that India’s economy has recovered from the Covid disruption and is poised for sustained robust growth which will be higher than for almost all major economies.

- Reference to 2003:

- The Survey argues that the situation in 2023 is similar to 2003, when the Indian economy was poised for growth.

- Likelihood:

- India’s potential growth rate is unlikely to rise much above 6% in the next few years.

Importance of Economic Survey

- Provides an overview of the current state of the economy:The Survey gives an overview of the performance of the Indian economy in the current financial year, including GDP growth rate, inflation, the balance of payments, and other key macroeconomic indicators.

- Identifies key economic challenges: The Survey identifies key challenges facing the Indian economy and provides insights into how they can be addressed which is crucial for policymakers, who use this information to formulate their economic policies.

- Offers policy recommendations: The Survey provides policy recommendations to the government on how to address economic challenges and promote economic growth and development. This is important for businesses and investors, who can use these recommendations to plan their investments and strategies.

- Guides future economic policies: It provides a roadmap for future economic policies, including a projection of GDP growth, inflation, and other key macroeconomic indicators.

- Supports data-driven decision making: The Survey provides a comprehensive and in-depth analysis of the Indian economy, including data and evidence-based insights.

Limitations of Economic survey

- Data Availability: The lack of reliable data sources and the delay in the release of official data can pose challenges for the preparation of the survey.

- Forecasting: Predicting the future state of the economy can be challenging, especially in an environment of economic volatility and uncertainty.

- Representation of Diverse Sectors: The Indian economy is diverse and multi-faceted, and the survey must be comprehensive enough to represent the varying sectors and their interlinkages.

- Balancing Policy Recommendations with Objectivity: The Economic Survey is expected to be both policy-oriented and objective in its analysis which is challenging as it requires a delicate balance between providing policy recommendations and retaining its independence.

- Addressing Political Pressures: The Economic Survey is a political document, and it must be prepared in such a way that it aligns with the government’s political objectives while also remaining credible and objective.

- Managing Expectations: The Survey is widely read and analyzed, and managing public expectations about its contents can be challenging.

Way forward:

- Well-researched policy ideas of economic survey serve as an intellectual public good by triggering a debate and forcing policy influencers to think about these issues.

- With much global uncertainty in corporate investment and precarious asset markets, the emphasis on public capital expenditure to boost the economy is prudent and wise.

- The Economic Survey is the only medium in the country for a rigorous, thoughtful and nuanced discussion of new economic ideas.

- India-UAE Comprehensive Economic Partnership Agreement (CEPA) is the first deep and full free trade Agreement (FTA) signed by India with any country in the past decade.

- It officially entered into force in May 2022.

- It covers Trade in Goods, Rules of Origin, Trade in Services, Technical Barriers to Trade (TBT), Sanitary and Phytosanitary (SPS) measures, Dispute Settlement etc.

- India has already signed a CEPA with Japan and South Korea.

Significance of CEPA

- Expected to increase total value of bilateral trade in goods to over US$100 billion and trade in services to over US$ 15 billion within five years.

- Eliminated duties for 90% of India’s exports to UAE, covering sectors such as gems and jewellery, textiles, leather, etc.

- Exports benefiting from India-UAE free trade pact accounted for about 60% of India’s total non-oil shipments to UAE.

India- UAE relations

- UAE is India’s third largest trading partner after United States and China and second-largest export destination.

- UAE has highest number of Indian diasporas contributing high remittances to India.

- UAE’s Nayif-1 nanosatellite has successfully been launched into space by ISRO.

Type of Trade Agreements

Free Trade Agreement (FTA):

- A free trade agreement is an agreement in which two or more countries agree to provide preferential trade terms, tariff concession etc. to the partner country.

- India has negotiated FTA with many countries e.g. Sri Lanka and various trading blocs as well e.g. ASEAN.

Preferential Trade Agreement (PTA):

- In this type of agreement, two or more partners give preferential right of entry to certain products. This is done by reducing duties on an agreed number of tariff lines.

- Tariffs may even be reduced to zero for some products even in a PTA. India signed a PTA with Afghanistan.

Comprehensive Economic Partnership Agreement (CEPA):

- Partnership agreement or cooperation agreement are more comprehensive than an FTA.

- CEPA covers negotiation on the trade in services and investment, and other areas of economic partnership.

- India has signed CEPAs with UAE, South Korea and Japan.

Comprehensive Economic Cooperation Agreement (CECA):

- CECA generally covers negotiation on trade tariff and TRQ (Tariff Rate Quotas) rates only. It is not as comprehensive as CEPA. India has signed CECA with Malaysia.

General Studies Paper 3

Context:

- Agronomists deliberated on the potential of Millet revolution in India.

Key Takeaways:

- Millets have special nutritive and agronomic properties (high in protein, dietary fiber, micronutrients, antioxidants and drought-resistant)

- In recent years, there has been a decline in area under millet cultivation with production of sorghum and pearl millet has fallen/stagnated, while production of other millets has declined.

- As per S. Swaminathan Research Foundation, there is need to preserve crop diversity, increase production/consumption, enhance farm incomes

- Previously, Food and Agriculture Organization of the United Nations has declared 2023 as “International Year of Millets” post the proposal for it by India.

Millets in India:

- Millets are a group of small-seeded cereal crops that are widely grown in India for their high nutritional value and drought tolerance.

- Indian millets are drought tolerant and mostly grown in arid and semi-arid regions of India.

- They are small-seeded grasses belonging to the botanical family Poaceae and are known as “coarse cereals” or “cereals of the poor”.

- In India, there are two groups of millets grown viz.,

- Major – sorghum, pearl millet, finger millet

- Minor – foxtail, little millet, kodo, proso, barnyard millet

- Historically, millets have been an important staple food in rural India mainly as a kharif crop,especially in the semi-arid regions where other crops may not be able to grow well.

Key data on Millets in India:

- In 2019-20, the total offtake of cereals through the Public Distribution System and the Integrated Child Development Scheme was around 54 million tonnes, 20% replacement by millet would require procurement of 10.8 million tonnes

- Total production of nutri-cereals in 2019-20 was7 million tonnes, the majority being maize

- Millets are procured in only a few states and central stocks are small (33 million tonnes of rice, 31 million tonnes of wheat, 4 lakh tonnes of nutri-cereals)

- During 2018-19, three millet crops bajra (3.67%), jowar (2.13%), and ragi(0.48%) accounted for about 7 per cent of the gross cropped area in the country.

- India is a top 5 exporter of millets, exported $64.28 million in 2021-2022 alone.

Advantages of Millets

- High in nutrient content: Millets are rich in fiber, vitamins, minerals, and antioxidants, making them a nutritious food choice.

- Gluten-free: Many people with celiac disease or gluten intolerance can safely consume millets as they are naturally gluten-free.

- Promotes weight loss: Millets have a low glycemic index, meaning they are slowly digested and absorbed, which helps regulate appetite and prevent overeating.

- Supports cardiovascular health: Millets are rich in magnesium and polyunsaturated fatty acids, which help to lower blood pressure and reduce the risk of heart disease.

- Increases energy levels: Millets are a good source of carbohydrates, providing a steady source of energy throughout the day.

- Supports digestive health: Millets are high in fiber, which promotes bowel regularity and can help alleviate symptoms of constipation.

- Suitable for multiple diets: Millets are suitable for various diets, including vegan, vegetarian, and gluten-free diets.

- Adaptable and drought-resistant: Millets are highly adaptable to different growing conditions and are resistant to drought, making them a valuable food source in regions with unreliable water supply.

- Supports farmers: The cultivation of millets is beneficial to small-scale farmers as they are relatively easy to grow and require low inputs, which results in lower costs and higher profitability

Challenges of Millets

- Low demand and consumption: Millets are not as popular as rice and wheat, leading to low demand and consumption.

- Lack of processing facilities: Processing and value-addition is limited, which affects the marketability and profitability of millets.

- Low investment in research and development: There is a lack of investment in research and development of millets, leading to limited information on their cultivation, storage, and utilization.

- Inadequate storage and transportation infrastructure: Inadequate storage and transportation facilities lead to post-harvest losses and difficulty in reaching markets.

- Limited marketing and branding: Millets lack proper marketing and branding, making them less attractive to consumers.

- Competition from cheaper imports: Cheaper imports of grains like wheat and corn often displace millets in the market.

- Poor awareness: Limited awareness about the nutritional and health benefits of millets among consumers and farmers is a challenge

Steps taken by Government to promote Millets:

- National Food Security Mission: Launched in 2007, the National Food Security Mission aims to increase the production of rice, wheat, and pulses in India to meet the growing food demand of the country’s population.

- National Mission on Oilseeds and Oil Palm: This mission was launched in 2010 to increase the production of oilseeds and oil palm in India, in order to improve the livelihoods of farmers and enhance the availability of oil for domestic consumption.

- National Bamboo Mission: Launched in 2006, the National Bamboo Mission aims to promote the cultivation and use of bamboo in India. It provides support for the development of the bamboo industry, including research and development, marketing, and infrastructure development.

- National Mission on Sustainable Agriculture: Launched in 2010, the National Mission on Sustainable Agriculture aims to make Indian agriculture more sustainable, productive, and profitable. This mission focuses on improving the soil health, water management, and cropping practices in Indian agriculture.

- National Mission for Sustainable Livelihoods: Launched in 2011, the mission aims to provide sustainable livelihoods to the rural poor in India. This mission focuses on enhancing the livelihoods of the rural poor through skill development, job creation, and micro-enterprise development.

- Rashtriya Krishi Vikas Yojana:Launched in 2007, it is a central sector scheme aimed at improving the productivity of agriculture in India by providing financial support for the development of irrigation, soil and water conservation, and other infrastructure in the agriculture sector.

Way forward:

- Encouraging and supporting farmers to adopt millet cultivation through subsidies and better market access

- Promoting millet based value-added products to increase demand and profitability

- Improving millet seed quality and distribution through government and private initiatives

- Offering training and extension services to farmers on the latest millet cultivation techniques

- Enhancing research and development efforts to improve the yield and quality of millet crops

- Improving storage and transportation facilities to reduce post-harvest losses

- Promoting intercropping with millets to increase farm efficiency and income

- Encouraging partnerships between farmers, processors, and retailers to create a sustainable millet value chain

- Encouraging international collaborations to share best practices and knowledge in millet production and marketing.

© 2025 Civilstap Himachal Design & Development