- Phone :+917814622609

- Email :[email protected]

- Student Dashboard

CivlsTap Himachal, Himachal Pradesh Administrative Exam, Himachal Allied Services Exam, Himachal Naib Tehsildar Exam, Tehsil Welfare Officer, Cooperative Exam and other Himachal Pradesh Competitive Examinations.

General Studies Paper-2

Context: The heads of government meeting of the Shanghai Cooperation Organisation (SCO) was attended by India, Pakistan, China, Russia and six other member countries.

- External Affairs Minister S Jaishankar travelled to Islamabad for the meeting, the first such visit in nine years.

Key Takeaways

- Due to territorial sovereignty issues, India remains the only SCO member to oppose China’s Belt and Road Initiative (BRI).

- The SCO’s joint communique reaffirmed support for China’s BRI.

- The summit saw criticism of Western sanctions on Russia and Iran, which were deemed harmful to international trade and economic relations.

- Discussions between India and Pakistan indicated a potential resumption of cricket ties, though these are still early.

- In a reference to Pakistan, the External Affairs Minister said, “If activities across borders are characterised by terrorism, extremism and separatism, they are hardly likely to encourage trade, energy flows, connectivity and people-to-people exchanges in parallel.”

Shanghai Cooperation Organisation (SCO)

- Shanghai Five emerged in 1996 from a series of border demarcation and demilitarization talks between 4 former USSR republics and China.

- Kazakhstan, China, Kyrgyzstan, Russia and Tajikistan were members of the Shanghai Five.

- With the accession of Uzbekistan to the group in 2001, the Shanghai Five was renamed the SCO.

- Objective: To enhance regional cooperation for efforts to curb terrorism, separatism, and extremism in the Central Asian region.

- Members: China, Russia, India, Pakistan, Iran, Belarus and the four Central Asian countries of Kazakhstan, Kyrgyzstan, Tajikistan, Uzbekistan,.

- Observer status: Afghanistan and Mongolia.

- Language: The SCO’s official languages are Russian and Chinese.

- Structure: The supreme decision-making body of the SCO is the Council of Heads of States (CHS) which meets once a year.

- The Organization has 2 standing bodies — the Secretariat in Beijing and the Executive Committee of the Regional Anti-Terrorist Structure (RATS) in Tashkent.

Significance for India

- Regional Security: The SCO serves as a platform for addressing security concerns, including terrorism, separatism, and extremism, which are critical issues for India given its geographical and political context.

- Economic Cooperation: The organization facilitates economic collaboration among member states, which enhance trade and investment opportunities for India, particularly with Central Asian countries.

- Geopolitical Influence: India’s membership in the SCO helps enhance its influence in Central Asia and counterbalances the presence of China and Pakistan in the region.

- Central Asia: The SCO is especially important for India because its membership and focus emphasize Central Asia—a region where India is keen to ramp up ties but faces an inherent constraint with its outreach.

- In recent years, India has convened dialogues with Central Asian leaders to signal India’s commitment to partnership—and the visit by External Affairs Minister to Islamabad is to amplify that message.

Challenges

- China-Pakistan Axis: The strong partnership between China and Pakistan within the SCO complicates India’s strategic positioning, as at times it limits India’s influence in regional security discussions.

- Geopolitical Tensions: Ongoing border disputes and geopolitical tensions with China and Pakistan spill over into SCO discussions, making it difficult for India to engage constructively.

- Focus on Security over Economic Development: The SCO’s primary focus on security issues sometimes overshadow economic and developmental cooperation, which are crucial for India’s interests in the region.

Conclusion

- India has to maintain a delicate balance as the dynamics of the SCO are changing.

- The External Affairs Minister’s trip was intended to signal India’s commitment to the SCO, not to strengthen ties with Pakistan.

General Studies Paper-2

Context: In a 4:1 majority verdict, the Constitution Bench of the Supreme Court upheld the constitutionality of Section 6A of the Citizenship Act, 1955.

Background

- Section 6A of the Citizenship Act, 1955, confers citizenship to immigrants who entered Assam after January 1, 1966 but before March 24, 1971.

- The provision was inserted into the Act in furtherance of a Memorandum of Settlement called the “Assam Accord”.

- Under Section 6A, foreigners who had entered Assam before January 1, 1966, and been “ordinarily resident” in the State, would have all the rights and obligations of Indian citizens.

Concerns raised on the provision

- The cut-off date provides a different standard for citizenship for immigrants entering Assam than the rest of India (which is July 1948) and violates the right to equality (Article 14) of the Constitution.

- Also, the provision violates the rights of indigenous people from Assam under Article 29 by changing the demographics in the state.

Supreme Court ruling

- The Court opined that the mere presence of diverse ethnic groups within a state does not, in itself, constitute a violation of Article 29(1) of the Constitution (protection of interests of minorities).

- Section 6A is a statutory intervention that balances the humanitarian needs of migrants of Indian origin and the impact of such migration on economic and cultural needs of Indian states

Concluding remark

- The judgment underlined parliamentary supremacy over citizenship matters under Article 11 of the Constitution.

It also reinforced the Union government’s defense of amendments under the Citizenship (Amendment) Act of 2019, which is presently pending challenge in the Supreme court.

Read MoreGeneral Studies Paper-2

Context: The United Nations’ goal to eradicate world hunger by 2030 seems increasingly challenging to achieve due to the impacts of wars, climate change, and economic crises.

About

- Goal 2 of the United Nations Sustainable Development Goals (SDGs) is all about creating a world free of hunger by 2030.

- The 2024 Global Hunger Index score for the world is 18.3, with 42 countries still experiencing alarming or serious hunger.

- Hunger is most severe in sub-Saharan Africa and South Asia where the crisis has soared to humanitarian levels.

- Little progress has been made on reducing hunger since 2016, and the prospects for achieving Zero Hunger by the target date of 2030 are grim.

Food Insecurity in India

- India has been ranked 105th out of 127 countries in the Global Hunger Index (GHI) 2024, placing it in the “serious” category for hunger levels.

- The State of Food Security and Nutrition in the World 2023 report states that around 224 million people in India faced moderate or severe food insecurity in 2021-22.

What are the challenges?

- Wars and Conflicts: Ongoing conflicts like in the Red Sea, disrupt supply chains, and access to food, leading to severe hunger, especially in vulnerable regions like sub-Saharan Africa and South Asia.

- Climate Change: Extreme weather events, droughts, floods, and shifting agricultural patterns caused by climate change severely affect food production and availability.

- Regional Disparities: Hunger remains most severe in sub-Saharan Africa and South Asia, where conditions have escalated to humanitarian crises, making it harder to address hunger effectively in these regions.

- The COVID-19 pandemic exacerbated food insecurity, pushing many households into poverty and making it harder for them to access sufficient food.

India’s Efforts to achieve zero hunger by 2030

- Mid-Day Meal Programme: The Programme aims to boost enrolment, retention, and attendance while improving the nutritional status of children in government, local body, and government-aided schools.

- Food Fortification: The government promotes fortified rice, wheat flour, and edible oils as part of the public distribution system.

- The National Food Security Act, 2013: The Act provides for coverage of upto 75% of the rural population and upto 50% of the urban population for receiving subsidized foodgrains under Targeted Public Distribution System (TPDS).

- Poshan Tracker: The Ministry of Women and Child Development developed the Poshan Tracker ICT application as a key governance tool.

- It uses WHO’s expanded tables with day-based z-scores to dynamically assess stunting, wasting, underweight, and obesity in children based on height, weight, gender, and age.

- Pradhan Mantri Garib Kalyan Anna Yojana was launched to alleviate hardships faced by the poor due to economic disruptions caused by the COVID-19 outbreak.

- SakshamAnganwadi and Poshan 2.0 includes key schemes such as the POSHAN Abhiyaan, Anganwadi Services and Scheme for Adolescent Girls as direct targeted interventions to address the problem of malnutrition in the country.

Way Ahead

- Humanitarian Assistance: Provide more financial resources for humanitarian aid to conflict-affected regions to ensure food distribution and nutritional support.

- Sustainable Agriculture: Promote agricultural practices that can withstand shocks from climate change.

- Targeted Assistance Programs: Develop targeted food assistance programs for vulnerable populations affected by conflicts, including cash transfers and food vouchers.

General Studies Paper-1

Context: The World Survey on the Role of Women in Development report released by UN Women highlighting the widening gender gap in social protection.

About

- The report reveals that an alarming two billion women and girls are without access to any form of social protection. This is putting at risk progress towards Sustainable Development Goal 5 (SDG 5).

- Gendered poverty: Women aged 25 to 34 are 25 percent more likely than men in the same age group to live in extreme poverty.

- Conflict and climate change continue to exacerbate this inequality, with women in fragile environments being 7.7 times more likely to live in extreme poverty compared to those in stable regions.

- Maternity protection: Globally, over 63 percent of women still give birth without access to maternity benefits, with the figure reaching 94 per cent in sub-Saharan Africa.

Indian Scenario

- Health and Nutrition: The National Family Health Survey (NFHS-5) reveals that 23.3% of women (15-49 years) are undernourished, and 57% of women are anemic.

- The Maternal Mortality Ratio (MMR) in India was 97 per 100,000 live births in 2023, down from 130 in 2014.

- Gendered Poverty: According to Oxfam, 63% of women in India face unpaid caregiving responsibilities, which limits their economic participation.

- Labor Force Participation: In India, only around 37% of women aged 15 years and above participate in the workforce (compared to about 73% of men).

- Gender Gap in Education: As per NFHS-5, 70.3% of females are literate, compared to 84.7% of males.

Reasons of Vulnerability of Women

- Cultural Expectations and patriarchal norms restrict women’s opportunities to participate in formal employment and hinders their access to economic independence.

- Educational Disparities: Cultural practices like early marriage, gender-based violence in schools, and lack of sanitation facilities disproportionately affect girls’ attendance and retention rates in education.

- Informal Sector Employment: A large percentage of women are employed in informal sectors, which are characterized by low wages, irregular hours, and lack of job security.

Government Initiatives

- Beti Bachao Beti Padhao (BBBP): Launched to address the declining child sex ratio and promote education and survival of the girl child.

- Pradhan Mantri Matru Vandana Yojana (PMMVY): A maternity benefit scheme providing financial assistance to pregnant and lactating mothers to ensure safe delivery and proper nutrition.

- Ujjwala Scheme: Provides free LPG connections to women from below poverty line (BPL) households to reduce health issues caused by smoke from traditional chulhas.

- Poshan Abhiyaan: This mission aims to improve nutrition outcomes for children, pregnant women, and lactating mothers.

- Digital Literacy Programme for Women: It is part of Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) and empowers women to access e-governance services and financial platforms, helping them participate in the digital economy.

- One Stop Centre Scheme (Sakhi Centres), aims to facilitate women affected by violence with a range of integrated services under one roof such as Police facilitation, medical aid, legal aid and legal counseling, psycho-social counseling, temporary shelter, etc.

Way Ahead

- The poor condition of women is a product of deeply rooted patriarchal norms, discriminatory practices, economic inequalities, and lack of targeted policies that address the specific needs of women.

- Addressing these systemic issues requires a comprehensive approach that includes improving access to education, healthcare, and legal protections, while promoting gender-responsive social protection policies.

Gender budgeting is a critical tool for advancing gender equality, promoting women’s empowerment, and achieving inclusive and sustainable development in India.

Read MoreGeneral Studies Paper-2

Context: The Prime Minister of India recently addressed the 19th East Asia Summit (EAS) in Vientiane, Lao PDR.

India’s Total Renewable Energy Capacity Crosses 200 GW Mark

Last updated on October 16th, 2024 Posted on October 16, 2024 by NEXT IAS Current Affairs Team 49

Context

- India has reached a significant milestone as the country’s total renewable energy capacity crosses the 200 GW (gigawatt) mark in 2024.

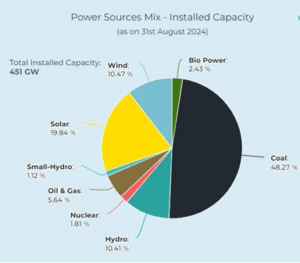

India’s Energy Basket

India’s Renewable Energy Capacity

- India’s total electricity generation capacity has reached 452.69 GW.

- Having the 8,180 MW (megawatt) of nuclear capacity, the total non-fossil fuel-based power now accounts for almost half of the country’s installed electricity generation capacity.

- As of 2024, renewable energy-based electricity generation capacity stands at 201.45 GW, accounting for 46.3 percent of the country’s total installed capacity.

- Solar power contributes towards 90.76 GW, wind power follows closely with 47.36 GW, hydroelectric power generating 46.92 GW and small hydro power adding 5.07 GW, and biopower, including biomass and biogas energy, adds another 11.32 GW.

India’s Targets

- India has a vision is to achieve Net Zero Emissions by 2070, in addition to attaining the short-term targets which include:

- Increasing renewables capacity to 500 GW by 2030,

- Meeting 50% of energy requirements from renewables,

- Reducing cumulative emissions by one billion tonnes by 2030, and

- Reducing emissions intensity of India’s gross domestic product (GDP) by 45% by 2030 from 2005 levels.

Challenges in Renewable Energy

- High Upfront Costs: The initial investment for renewable energy infrastructure, such as solar panels and wind turbines, is significant, which can be a barrier for many regions and investors.

- Geographical Disparities: Renewable resources are unevenly distributed, with some regions having limited access to wind or sunlight. This geographical imbalance can limit the feasibility of renewable energy adoption in certain areas.

- Governance Issue: Inconsistent government policies, regulatory challenges, and bureaucratic delays can slow down project approval and implementation, creating uncertainty for investors and developers.

- Infrastructure Development: The transition to renewable energy requires significant infrastructure development.

- The speed and scale of this infrastructure development can be a challenge for a country as large and diverse as India.

- Grid Integration: Integrating renewable energy into the existing power grid is a complex task.

- The grid must be flexible and capable of handling fluctuations in supply.

Steps Taken by Government for Transition to Renewable Energy Sources

- National Solar Mission (NSM): It was launched in 2010, it has set ambitious targets for solar capacity installation, including grid-connected and off-grid solar power projects.

- Green Energy Corridors: The Green Energy Corridor project focuses on enhancing the transmission infrastructure to facilitate the integration of renewable energy into the national grid.

- National Wind Energy Mission: Focuses on the development and expansion of wind energy in India. The target for wind energy capacity is set at 140 GW by 2030.

- National Clean Energy Fund (NCEF): It was established to support research and innovation in clean energy technologies and projects that help in reducing greenhouse gas emissions.

- Renewable Purchase Obligation (RPO): This requires power distribution companies and large electricity consumers to procure a certain percentage of their power from renewable sources, encouraging the demand for renewable energy.

- Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM): It includes the installation of solar pumps, solarization of existing grid-connected agricultural pumps, and the establishment of solar power plants on barren or fallow land.

- International Solar Alliance (ISA): India played a key role in establishing the International Solar Alliance, a coalition of solar-resource-rich countries to address their energy needs through the promotion of solar energy.

Conclusion

- This accomplishment is a testament to the nation’s commitment to a sustainable energy future including solar, wind, hydro, and bioenergy.

- With ambitious targets set for the future, India is well-positioned to emerge as a global leader in renewable energy, contributing to environmental sustainability and energy security.

- These ongoing efforts reflect a holistic approach to building a greener economy, ensuring that India not only meets its energy needs but also addresses the pressing challenges of climate change and resource conservation.

General Studies Paper-1

Context: Global warming is raising sea levels and making flooding more common in some areas.

- Researchers have held them responsible for discouraging the growth of plants of many tree species in coastal areas.

About

- The study paper has reported that a rising sea and coastal flooding could actually enhance the resilience of some coastal tree species while being detrimental to others.

- One species in particular, the American holly (Ilex opaca), responded by increasing the rate at which it grew — while loblolly pine (Pinus taeda) and pitch pine (Pinus rigida) trees suffered under higher water levels.

- Cause: The tree rings consist of water vessels. When a tree is exposed to a lot of rain along with appropriate levels of sunlight and ambient temperature, it also develops more water vessels.

- But a heavy downpour and a deluge would disrupt this process altogether and prevent the plant from growing normally.

Sea-level Rise Accelerating

- Sea levels were increasing by around 2 mm/year in 1993.

- This rate has since doubled and climate researchers expect floods in coastal areas will increase threefold by 2050.

- Reason: Climate change brought on by fossil-fuel burning and greenhouse gas emissions has led to a steady increase in global temperatures.

- As a result, sea surface temperatures and glacier melting have increased, eventually rising sea levels and posing a major threat to coastal cities worldwide, including Indian coastal cities.

Concerns with Increase in Sea Level

- Flooding: It leads to more frequent and severe flooding in coastal areas, threatening infrastructure, homes, and livelihoods.

- Displacement: Rising seas force communities to relocate, leading to displacement and potential conflicts over resources.

- Saltwater Intrusion: Salinity contaminate freshwater sources, affecting drinking water supplies and agriculture.

- Economic Impact: Coastal industries, such as fishing and tourism are severely impacted, leading to job losses and economic instability in affected regions.

- Biodiversity Loss: Ecosystems like mangroves and coral reefs are threatened, impacting biodiversity and the services these ecosystems provide.

- Health Risks: Flooding leads to the spread of waterborne diseases.

India’s Efforts to Combat Climate Change

- Renewable Energy Expansion: India has set ambitious targets for renewable energy generation, aiming to increase its capacity significantly.

- It has invested heavily in solar and wind energy projects, with the goal of reducing reliance on fossil fuels and lowering greenhouse gas emissions.

- International Commitments: India is a signatory to the Paris Agreement, committing to reduce its carbon intensity and increase the share of non-fossil fuel energy sources in its total energy mix.

- It has announced its aim to meet 50% of its electricity demands from renewable energy sources by 2030.

- Afforestation and Forest Conservation: Recognizing the role of forests in carbon sequestration and climate regulation, India has initiated programs to increase forest cover, restore degraded lands, and promote sustainable forest management practices.

- Clean Transportation: India is promoting the adoption of electric vehicles (EVs) and has set a target of 30% EV market share by 2030.

- The government has introduced incentives and subsidies to support the production and adoption of EVs.

- Climate Resilience: India is investing in measures to enhance climate resilience and adaptation, particularly in vulnerable sectors such as agriculture, water resources, and coastal areas.

- International Cooperation: India actively participates in international forums and collaborations on climate change, engaging in initiatives such as the International Solar Alliance and the Coalition for Disaster Resilient Infrastructure.

General Studies Paper-2

Context: The Prime Minister of India recently addressed the 19th East Asia Summit (EAS) in Vientiane, Lao PDR.

Key Highlights

- The PM emphasized that a free, open, inclusive, prosperous and rule-based Indo-Pacific is important for the peace and progress of the entire region.

- India stressed that maritime activities should be conducted under the UN Convention on the Law of the Seas (UNCLOS) to ensure freedom of navigation and air space.

- Also a strong and effective Code of Conduct should be created.

East Asia Summit (EAS)

- Origin: The origins of EAS dates back to the 1990 proposal for an East Asian Economic Grouping (EAEG).

- The project was later revived through the ASEAN Plus Three or APT (China, Japan, and South Korea) Summit of Heads of State and Government that first met in Kuala Lumpur in December 1997.

- It eventually found expression through the creation of the EAS in 2005, with 16 members. The United States and Russia joined in 2011.

- Members: There are 18 members;

- The 10 ASEAN (Association of Southeast Asian Nations) members: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

- 8 non-ASEAN members: Australia, China, India, Japan, New Zealand, Russia, South Korea, and the United States.

- Lead & the Chair position: ASEAN leads the forum, and the chair position rotates between ASEAN Member States annually.

Significance of East Asian region

- Economic Growth: East Asia is home to some of the world’s largest and fastest-growing economies, including China, Japan, and South Korea.

- The region is known as the factory of the world.

- Diplomatic Hotspot: As a zone of interaction for major global powers like the US, China, and Russia, the region is critical for international diplomacy and geopolitical negotiations, influencing global peace and stability.

- Great Power Rivalries: East Asia is a focal point for great power competition, particularly between the United States and China. The region plays a key role in shaping the dynamics of global power and influence.

- Strategic Waterways: The region includes vital shipping lanes such as the South China Sea and the East China Sea, where disputes over territorial claims add to its geopolitical importance.

Challenges

- Territorial Disputes: Ongoing territorial disputes in the South China Sea and East China Sea involve multiple countries, including China, Vietnam, the Philippines, Japan, and Taiwan, leading to increased military tensions and instability.

- Regional Alliances: The emergence of military alliances and partnerships in the region, such as the Quad (Quadrilateral Security Dialogue) involving the US, Japan, Australia, and India, complicates India’s relations with its neighbors and other East Asian countries.

- Regional Trade Agreements: India’s decision to opt out of the Regional Comprehensive Economic Partnership (RCEP) limits its access to East Asian markets.

Way Ahead

- India’s engagement with the East Asian region is characterized by a complex interplay of opportunities and challenges in the realm of international relations.

- Navigating geopolitical rivalries, economic competition, and diverse political landscapes requires a multifaceted approach, balancing national interests with the necessity of fostering cooperative and constructive relationships in this strategically vital region.

General Studies Paper-2

Context: India decided to withdraw its High Commissioner and other affected diplomats and officials from Canada.

India-Canada Bilateral Relations

- Foundation of Ties: India-Canada relations are based on shared values of democracy, cultural diversity, economic engagement, and people-to-people connections.

- High-Level Exchanges: In 2015, PM Modi visited Canada, leading to multiple agreements.

- In 2018, Trudeau visited India, signing six agreements in various sectors.

- COVID-19 Cooperation: Leaders discussed vaccine collaboration and evacuation of stranded citizens.

- G-7 Meeting (2022): The two PMs met to enhance bilateral relations.

- G20 Summit (2023): Trudeau attended the summit in India and met Modi.

- Bilateral Mechanisms: Established dialogues in trade, energy, and foreign affairs, with recent consultations in 2023.

- Security Cooperation: Counter-terrorism efforts under a Joint Working Group established in 1997.

- Civil Nuclear Cooperation: An agreement signed in 2010 for peaceful nuclear energy uses, with implementation oversight by a Joint Committee.

- Energy Cooperation: Expanded Ministerial level Energy Dialogue since 2018 to include renewables.

- Space Collaboration: MoUs signed for satellite tracking and astronomy; ISRO has launched Canadian satellites.

- Economic Relations: Total bilateral trade in 2023 reached USD 9.36 billion, with significant service trade.

- Canadian investments in India exceed CAD 75 billion, with over 600 Canadian companies operating in India

- Exports: Pharmaceuticals, electronic goods, jewelry, seafood, engineering goods.

- Imports: Minerals, pulses, potash, and chemicals.

- Science and Technology Cooperation: Multiple MoUs signed for research and technological collaboration.

- Education: Largest foreign student demographic in Canada is Indian, with around 427,000 students.

- People-to-People Relations: Canada has a significant Indian diaspora (approximately 1.8 million), contributing to its economy and society.

- Cultural Exchanges: Co-production agreements in films and joint initiatives between Canada Post and India Post.

- ICCR chairs established at various Canadian universities to foster cultural cooperation.

Diplomatic row

- In September 2023, Canadian PM Trudeau alleged Indian involvement in the murder of Hardeep Singh Nijjar, which India rejected.

- India advised its nationals in Canada and suspended visa services for Canadians.

- Visa Resumption: Services resumed in specific categories in October and e-visas for certain categories in November 2023.

- The Ministry of External Affairs said the “unsubstantiated allegations” sought to shift focus away from “Khalistani terrorists and extremists who have been provided shelter in Canada”.

- Concerns were raised about the safety of Indian diplomats, stating that the Trudeau Government’s actions contribute to an atmosphere of extremism and violence

Future Outlook

- The Government of India strongly rejects preposterous imputations and ascribes them to the political agenda of the Trudeau Government that is centered around vote bank politics

- India indicated it reserves the right to take further actions in response to what it perceives as the Trudeau Government’s support for extremism and violence against India.

General Studies Paper-2

Context: Nearly a year after Maldives President election, Mohamed Muizzu made his first bilateral visit seen as an attempt to mend fences with India, and the Prime Minister of India ensured that India is always the ‘first responder’ for the Maldives in times of need.

New Beginnings and Old Complexities in India-Maldives Ties

- The relationship between India and the Maldives has always been a blend of strategic cooperation and occasional friction.

Recent Developments

- The election of President Mohamed Muizzu marked a turning point in Maldives-India relations. Initially, Muizzu’s ‘India Out’ campaign rhetoric created tensions, but recent diplomatic efforts have aimed at mending these ties.

- It had vowed to change the Maldives’s ‘India First’ policy adopted under his predecessor Solih and remove Indian military personnel from the island nation.

- Additionally, After election result, his decision to visit Turkey, China, and the UAE before India further complicated matters

- President Muizzu’s visit to India and subsequent high-level discussions with Indian officials, including the Prime Minister, have paved the way for renewed cooperation.

Economic and Strategic Cooperation

- India has extended substantial economic support to the Maldives, including a $100 million subscription to Maldivian T-bills and a ₹3,000 crore currency swap arrangement. These measures are crucial for stabilising the Maldivian economy and managing its debt.

- Additionally, both nations have announced new joint infrastructure projects and are exploring a Free Trade Agreement, highlighting the economic interdependence between the two countries.

Defence and Security

- Security remains a critical aspect of India-Maldives relations. India’s military presence in the Maldives has been a contentious issue, with calls for the replacement of Indian troops with technical personnel. It aims to address Maldivian concerns while maintaining security cooperation.

- The strategic location of the Maldives in the Indian Ocean makes it a vital partner for India in ensuring regional stability and countering external influences, particularly from China.

Tourism and Investment

- Tourism is a cornerstone of the Maldivian economy, and India plays a significant role as a source market. President Muizzu’s visit to Agra, Mumbai and Bengaluru underscored the importance of Indian tourists and investors.

- Efforts to restore pre-pandemic tourist levels and attract Indian investments are crucial for the Maldives’ economic recovery.

China’s growing influence in the Maldives

- Geopolitical Competition: The Maldives’ strategic location in the Indian Ocean makes it a key player in the geopolitical rivalry between India and China. China’s increasing presence in the Maldives, through infrastructure projects and financial aid, challenges India’s traditional influence in the region.

- Economic Dependencies: China has invested heavily in the Maldives, particularly through the Belt and Road Initiative (BRI). These investments include major infrastructure projects like the Sinamalé Bridge and the expansion of Malé International Airport.

- While these projects boost the Maldivian economy, they also increase the Maldives’ debt to China, raising concerns about a potential ‘debt trap’.

- Security Concerns: China’s involvement in the Maldives extends to security cooperation, which can be seen as a counterbalance to India’s military presence. It creates tension, as India views the Maldives as part of its strategic sphere of influence and is wary of Chinese military activities in the region.

- Political Shifts: Changes in the Maldivian government often lead to shifts in foreign policy that can strain Maldives-India relations, especially when new agreements with China are perceived as undermining India’s interests.

- Public Sentiment and Diplomacy: The Maldivian public and political factions are divided on the issue of foreign influence. While some view China’s investments as beneficial, others are concerned about sovereignty and the long-term implications of Chinese debt. This division influences the diplomatic strategies of both India and China in the Maldives

India’s Multifaceted Strategy To Counter China

- Strengthening Regional Alliances: India actively engages with neighbouring countries to build strong bilateral relationships. It includes economic aid, infrastructure projects, and diplomatic support.

- For instance, India has enhanced its ties with countries like Bangladesh, Sri Lanka, and Nepal to counterbalance China’s influence.

- Strategic Partnerships: India collaborates with like-minded countries through multilateral forums and strategic partnerships. The QUAD (comprising India, the US, Japan, and Australia) is a key example, where these nations work together to ensure a free and open Indo-Pacific region.

- Military Modernisation: India is modernising its military capabilities to deter any potential threats from China. This includes upgrading its naval and air forces, enhancing border security, and conducting joint military exercises with allies.

- Economic Initiatives: India promotes regional economic integration through initiatives like the SAARC and the BIMSTEC. These efforts aim to create economic interdependence that can counter China’s Belt and Road Initiative.

- Infrastructure Development: India invests in infrastructure projects in neighbouring countries to provide alternatives to Chinese investments. This includes building roads, ports, and railways that enhance connectivity and economic growth in the region.

- Diplomatic Engagement: India engages in proactive diplomacy to address regional concerns and build goodwill. This includes high-level visits, cultural exchanges, and people-to-people connections to strengthen ties with neighbouring countries

Conclusion

- The turnaround in Maldives-India relations is a testament to the power of subtle diplomacy over muscular posturing. It underscores the importance of sensitive and nuanced engagement in international relations.

- As Prime Minister Modi aptly put it, India remains the ‘first responder’ for the Maldives in times of need, reaffirming the deep-rooted ties between the two nations.

General Studies Paper-3

Context: India has been ranked 105th out of 127 countries in the Global Hunger Index (GHI) 2024, placing it in the “serious” category for hunger levels.

What is the Global Hunger Index (GHI)?

- GHI is a tool for comprehensively measuring and tracking hunger at global, regional, and national levels.

- The index is published by Concern Worldwide, an Irish humanitarian organisation, and Welthungerhilfe, a German aid agency.

Findings of the GHI 2024

- The 2024 Global Hunger Index score for the world is 18.3, considered moderate, down only slightly from the 2016 score of 18.8.

- Little progress has been made on reducing hunger since 2016, and the prospects for achieving Zero Hunger by the target date of 2030 are grim, with 42 countries still experiencing alarming or serious hunger.

- The wars in Gaza and Sudan have led to exceptional food crises.

- Somalia, Yemen, Chad, and Madagascar are the countries with the highest 2024 GHI scores; Burundi and South Sudan are also provisionally designated as alarming.

- Progress has been notable for example in Bangladesh, Mozambique, Nepal, Somalia, and Togo, although challenges remain.

- India’s performance remains concerning, in comparison to the South Asian neighbours such as Bangladesh, Nepal, and Sri Lanka, which fall into the “moderate” category.

- India is listed alongside countries like Pakistan and Afghanistan, which also face severe hunger challenges.

- The report reveals alarming statistics:7 percent of India’s population is undernourished, 35.5 percent of children under five are stunted, 18.7 percent suffer from wasting, and 2.9 percent of children die before their fifth birthday.

Policy Recommendations

- Strengthen accountability to international law and enforce the right to food.

- Promote gender-transformative approaches in food and climate policies.

- Invest in gender, climate, and food justice, ensuring public resources address inequalities.

Initiatives by Government of India to address Hunger

- Mid Day Meal Programme: It is a flagship programme of the Government of India aiming at enhancing enrolment, retention and attendance and simultaneously improving nutritional levels among children studying in Government, Local Body and Government-aided primary and upper primary school areas across the country.

- The National Food Security Act, 2013: The Act provides for coverage of upto 75% of the rural population and upto 50% of the urban population for receiving subsidized foodgrains under Targeted Public Distribution System (TPDS), thus covering about two-thirds of the population.

- The Act also has a special focus on the nutritional support to women and children.

- Poshan Tracker: The Ministry of Women and Child Development developed and deployed the ‘Poshan Tracker’ ICT Application as an important governance tool.

- The Poshan Tracker has incorporated WHO’s expanded tables, which provide day-based z-scores, to dynamically determine stunting, wasting, underweight, and obesity status based on a child’s height, weight, gender, and age.

- The Central Government launched Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) with the specific purpose of ameliorating the hardships faced by the poor and needy due to economic disruptions caused by the COVID-19 outbreak in the country.

- The allocation of free food grains under PMGKAY was in addition to normal allocation done under the National Food Security Act (NFSA), 2013.

- Saksham Anganwadi and Poshan 2.0 (Mission Poshan 2.0) includes key schemes such as the POSHAN Abhiyaan, Anganwadi Services and Scheme for Adolescent Girls as direct targeted interventions to address the problem of malnutrition in the country.

- The beneficiaries under the Anganwadi Services scheme are children in the age group of 0-6 years, pregnant women and lactating mothers.

- Supplementary nutrition is provided to beneficiaries in the form of Hot Cooked Meals at Anganwadi Centres and Take Home Ration (not raw ration).

© 2024 Civilstap Himachal Design & Development